Verde Valley Real Estate 2020 in Review

2020 sales started out on a steady pace and then boom in February and March with the COVID-19 Pandemic the market came screeching to a halt, while everyone figured out how to deal with the Pandemic and buy an N95 mask finding that there were none available. Then as we all came to grips with how to work in the Pandemic, all hell broke loose with the market. With inventory already low, buyers started showing up from California and big cities all over the country looking to escape from forest fires and the pandemic resulting in a 15% year over year increase in the median sales price in Sedona to $650,000. Leaving us as of this writing with 50 active, not under contract, homes on the market with a median asking price of $1,297,500.

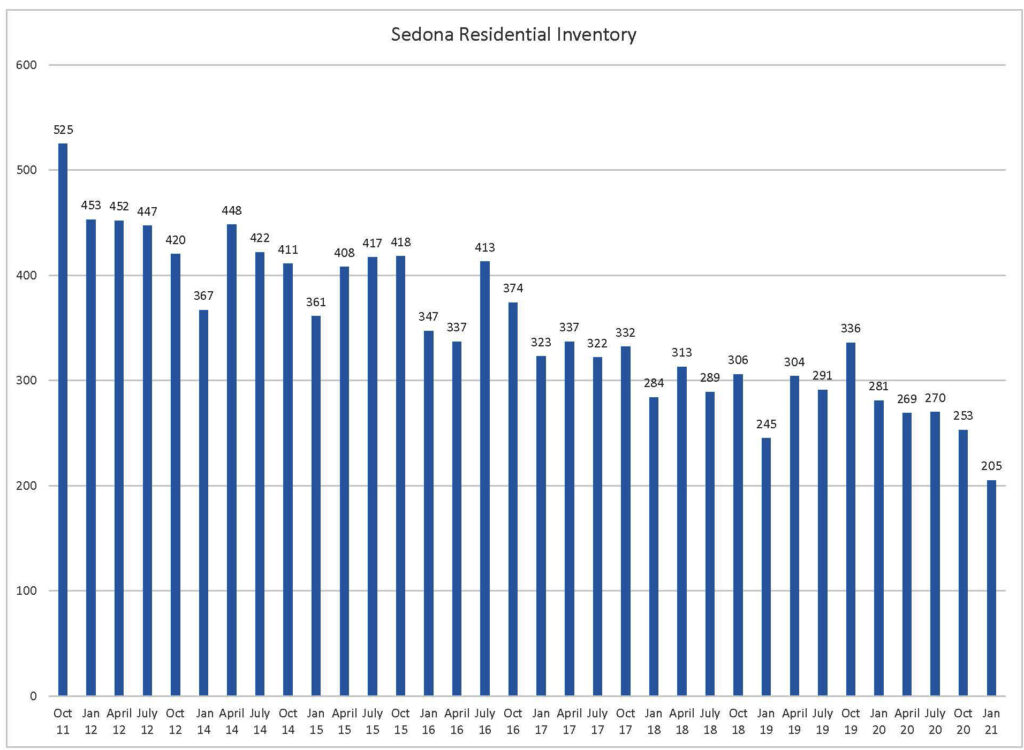

Residential inventory in Sedona and the Verde Valley has been on a decline for the last 10 years. Since the bottom of the market in 2011 all of the vacant homes have been occupied. Home builders have not been building enough homes to keep up with the million households that are created each year in this country resulting in a nationwide housing shortage.

The luxury market in the Sedona area heated up to a never-before-seen frenzy. A year ago, there were 87 homes in the Sedona area for sale, today there are 14. For 2020 there were 119 sales over $1,000,000 a 212% increase over 2019.

That is enough about 2020, what about 2021.

Mortgage rates will stay low—or may go a little higher.

Interest rates in 2020 were at historic lows for part of the year and have crept up a little at the end of 2020. The average rate for 2020 was at 3% and is expected to stay low and may rise slightly if the economy heats up a little as more people get the vaccine and feel more confident.

Prices will keep on rising.

Prices for residential real estate are expected to be strong throughout the country and I can see nothing on the horizon that will slow the increase for Sedona and the Verde Valley. With folks able to sell their homes for increased prices in other areas of the country they will be able to afford our homes too. As my uncle used to say “they will be trading $10,000 cats around”.

A real downside for the ever-increasing residential values in Sedona and the Verde Valley is that folks who are still working and wanting to afford a home cannot. Even with low interest rates the median income family cannot afford the median sale priced home anywhere in the Verde Valley. Where are folks who work in the Verde Valley going to live? This will turn critical for Verde Valley employers.

Inventory will be tight.

As I have stated before, many homeowners have locked in low interest rates, Baby Boomers are staying healthy longer and staying put in their existing homes. You cannot buy what is not for sale. The Baby Boomer generation is part of the challenge for Millennials, as many are choosing to age in place keeping more homes off the market than ever before. Although the COVID-19 Pandemic may have slowed some folks from making a move, I do not see that as having much of an effect in Sedona and the Verde Valley. I expect there to be demand coming from California and the upper Midwest like we have seen before but maybe even stronger this year. At this point homes are selling within a few days of when they come on the market and I do not see that changing any time soon with inventory as tight as it is and demand as strong.

Just the Facts:

Sedona area: The median price of a single-family home rose to $650,000 the highest median sales price ever. This was a 15% increase over 2019, an $85,000 increase in one year. This $85,000 increase was fueled by a 27% increase in the number of single-family sales to 631 sales in 2020 the highest number of annual sales in the Sedona market ever. The high number of sales resulted in a critical shortage of homes for sale. The inventory of all residential properties for sale decreased since January of 2020 a staggering 27%

Vacant land transactions for 2020 came in at 198, a 30% increase over 2019. This was the highest number of vacant land sales since 2005. Driven by the increased number of sales, the median sales price for vacant land rose 24% to just under to $199,125, its highest number since 2008. The increase in the number of sales has also resulted in a 21% decrease in the number of lots for sale to 205, its lowest number in many years.It is safe to say that the luxury market, home sales over $1,000,000 was the driving force in the 2020 market. Single family sales over $1,000,000 accounted for 19% of the sales in 2020 coming in at 119 sales, a mind-altering increase of 212% up from 56 sales in 2019. A year ago, there were 87 homes for sale over $1,000,000 as of this writing there are 14.

Cumulative days on the market came in at 84 days, two days longer than in 2019. With the sales activity that we are seeing in the market today I am expecting a significant drop in the time on the market for 2021

Not unexpectedly with the dramatic increase in the price for single family home we saw a dramatic increase in the median sales price for condos and townhomes to $389,174 up 25% over 2019’s $310,000. The number of transactions for the last 12-month period is 118, down 12% from 2019

The median price for mobile homes came in at $326,000 up a sizeable 16.5% over 2019. Sales were off slightly to 32 sales from 36 in 2019.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for 2020 was $297,500 up 10%% from 2019. Its highest yearly total ever. The number of sales was up 7% to 104 sales.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for 2020 was $235,000 up 2% from 2019. This is an all-time high for this area. The number of sales came in at 76 sales down 5% from 80 sales in 2019. Inventory of homes in this area is very tight.

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for 2020 was $325,000 up 12% over 2019. This is the highest median sales price in this area ever. The number of sales in 2020 was up 7% over 2020 to 601 sales contributing to the all-time high price.

The Bottom Line: Inventory is acutely tight. Demand is strong. Interest rates are low. The market will continue to be very tight with homes going under contract very quickly. You cannot just go “Abracadabra” and have a home show up, so sellers will be in the driver’s seat for 2021.

For the complete 2020 Verde Valley Real Estate Review

Recent Comments