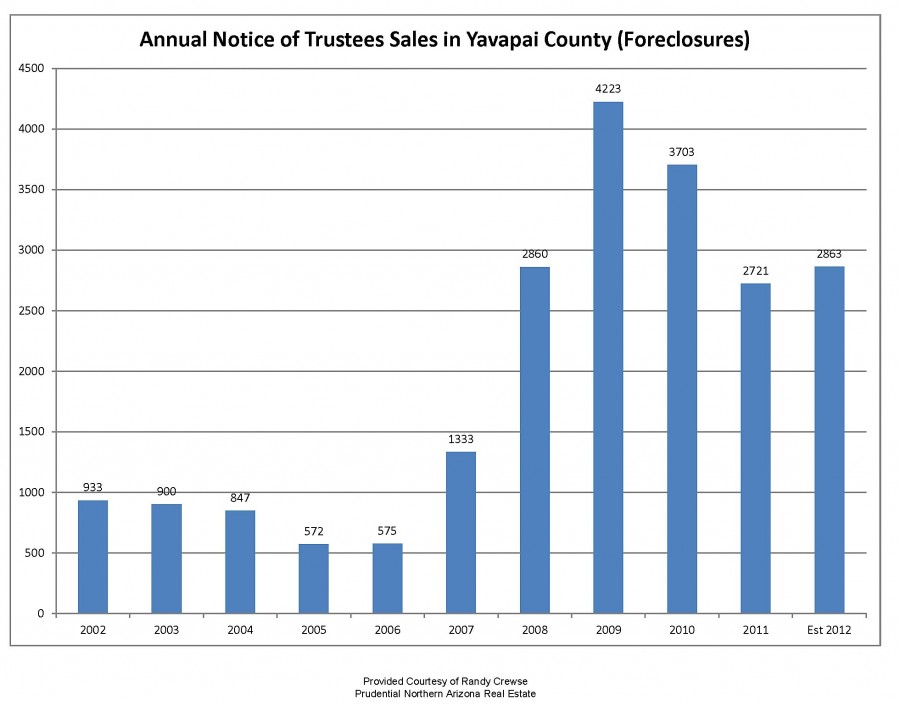

The Sedona real estate market continues to be impacted by foreclosures and short sales, and will be for the foreseeable future. The bellwether indicator for foreclosed homes coming on the market is the Notice of Trustees Sales recorded. Since the majority of Sedona real estate is in Yavapai County, I keep track of those recordings. In Arizona lenders use a note secured by a deed of trust for their loan documents, our name for a mortgage. When a loan is over 30 days past due, the lender can start the foreclosure process. They usually wait for the borrower to get 90 days or longer behind. At that point they start the process by filing a “Notice of Trustee’s Sale”. A borrower then has 90 days to cure the delinquency or the home is auctioned off on the courthouse steps, in Yavapai County, that is in Prescott. Once a borrower gets over 90 days behind it is very unlikely that they will caught up and these homes are either foreclosed on or they become a short sale.

As you can see from the graph below the Notice of Trustee’s Sales in Yavapai County are still being recorded at a high rate. They have come down significantly from their height in 2009, but they are still significantly higher than the more “normal” years of 2002 to 2005. At any given time there is always going to be borrowers that get behind or get in trouble on their obligations for all the reasons. But before this current real estate crisis they were able to sell their way out of their home obligations. I can remember answering the phone in about 2002 and someone asking me if we had any foreclosures for sale and smugly saying “we don’t have anything like that in Sedona”, little did we know what was on the horizon. I am basing the 2012 estimate on the 1193 Notice of Trustees sales that have been recorded in Yavapai County through May of 2012.

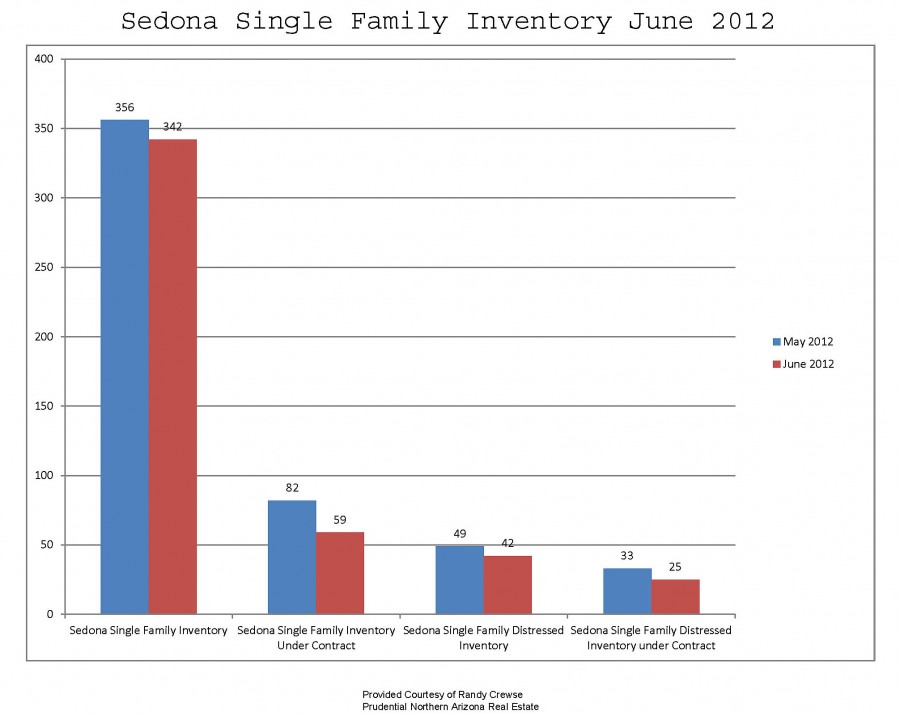

The Notice of Trustees Sales recordings turn into distress inventory that comes on the market in the form of either foreclosed homes or listed for sale as “short sales”. From the graph below you can see that as of this writing we have 342 single family homes listed for sale and of those 42 are distressed inventory. And that 25 of the distressed inventory is under contract. In case you are wondering the inventory of single family homes has been on the decline since 2009 and it is a buyer’s market, I know WHAT, for homes under $500,000.

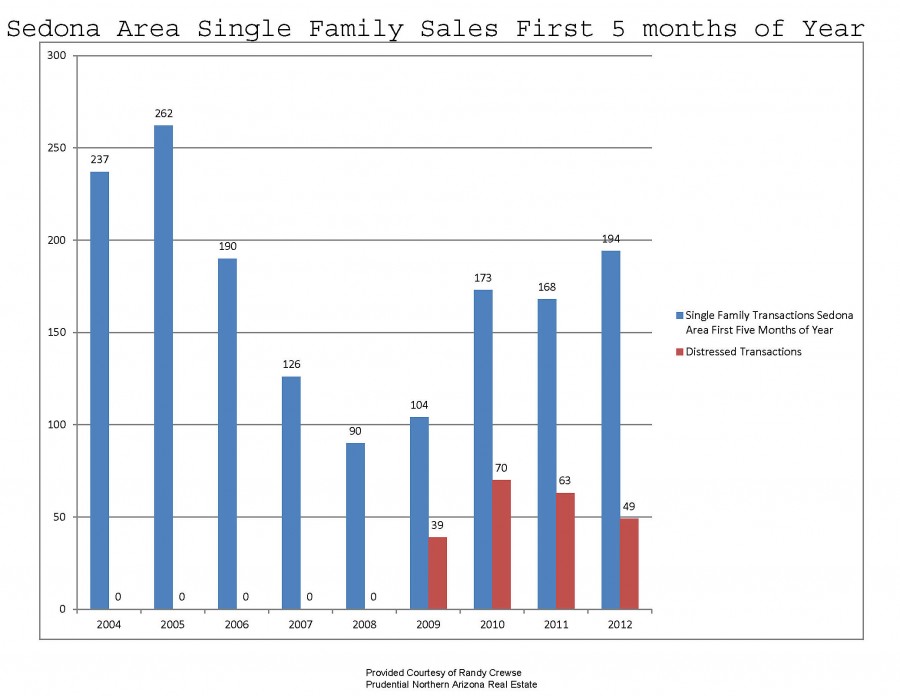

So what does all this translate to? The final graph below shows Sedona area homes that have sold in the first 5 months of the year from 2004 through 2012. During the first five months of the year up until 2009 there were no distressed transactions. Since that time they have been as high as 40% of the transactions in 2009 down to 25% year to date 2012. The good sign is that they appear to be on a downward trajectory, they need to get a lot lower for the market to really turn around.

Bottom Line: The Sedona real estate market, in all its beauty, just like the Phoenix market, has not been immune to the devastation caused by the real estate crash. We will continue to see distressed inventory in the Sedona real estate market, but hopefully in smaller numbers. With the reduction of inventory and the sales pace we are currently on, we may even see an increase in median sales price as we move through the summer and fall selling season. Interest rates are great, if Sedona is in your real estate future, it might be time to make it now. All indications are that there will be fewer distressed properties on the market as time goes by, we can hope! Click here to see all the Sedona Foreclosures For Sale that are currently on the market.

Recent Comments