Sedona and Verde Valley Real Estate Third Quater 2019

We look at the past to help us predict the future or at least to not be surprised when things appear to make changes out of nowhere. Last quarter we saw that the median sales price for the first 6 months of 2019 had taken a 4% drop compared to the median sales price for the first six months of 2018. Now nine months into 2019 we see that the median sales price for the first nine months of 2019 is up 1%. We need to keep an eye on this in light of the almost 10% average yearly increase in median sales price over the three previous years.

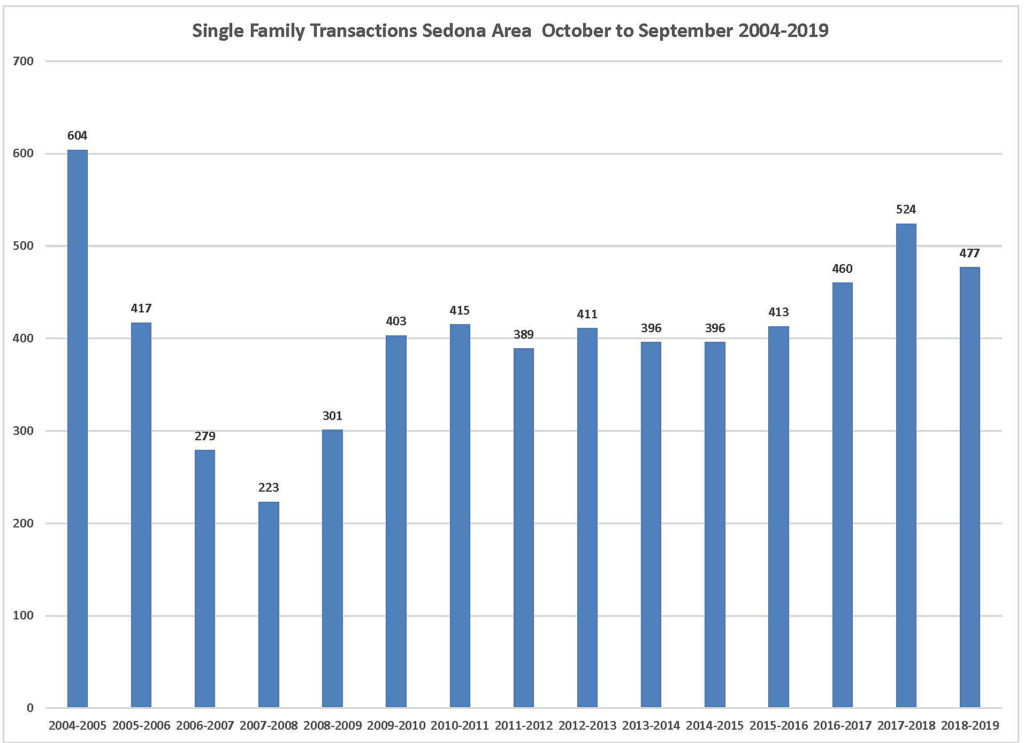

Now add into the calculation the 9% drop to 477 transactions in the last 12 months compared to the 524 sales in the previous 12 months and you have to wonder just where are we going. Since we are a very small market in the whole scheme of things and our numbers are not large enough to really say that a trend is developing over a short period of time, this does bear watching: We have a leveling off in the median sales price with a drop in the number of transactions.

What makes looking at these statistics so challenging is that when looking at the Verde Valley with our four different market areas we have real diversity in our statistical results:

- Sedona area residential inventory increased in the last quarter by 15.4% but Verde Valley residential inventory decreased by 6%.

- While the median sales price in the Sedona area was leveling off, the median sales price for Cottonwood/Cornville was up 13%, Camp Verde up 10%, Lake Montezuma/Rimrock up 4%. All of these areas experiencing all-time highs in their median sales price.

- While the median sales prices were up in three of the four areas in the Verde Valley and flat in Sedona the number of single-family transactions for the Verde Valley in the last 12 months was off 7% to 1186 sales compared to 1279 sales in the previous 12 months.

- Outside forces on our local real estate market continue to be favorable. Interest rates for a conventional loan for a buyer with good credit is running in the 3.75% range, great rates. The economy is still remaining strong both in Arizona and the rest of the country. Our feeder markets in California and the upper Midwest are still sending us buyers. Baby boomers are retiring is the staggering number of 10,000 per day. No negative influence in any of these indicators.

Just the Facts:

Sedona area: The median price of a single-family home rose 1% in the last 12-month period to a median sales price of $560,000, which is also the same number as the first 9 months of the 2019. The number of transactions in the last 12 months is down 9 % year over year to 477 sales, which is similar to the first 9 months of 2019 which is down 7% when compared to the first 9 months of 2018. Residential inventory reached its highest point in the Sedona area in two years with 336 units available as of early October 2019. The rise in inventory along with the slowdown in single family sales will be something to keep our eyes on in the upcoming months.

Vacant land transactions year over year were off 9% for the last 12-month period, coming in at 148 sales compared to 162 sales for the previous 12-month period. The median sales price rose 5% year over year to $155,0000 up from $147,500 for the previous 12-month period. This rise to $155,000 is unremarkable when compared to the median sales price for vacant land which has sold in the in the range of $130,000 to $155,000 during the last 6 years.

The Sedona area luxury market, prices over $1,000,000, came in at 58 sales for the last 12-month period. This is the highest number of sales over $1,000,00 ever recorded in the Sedona market area. This was a 20% increase over the previous 12-month period. Year to date there have been 47 sales over $1,000,000 which puts us on track for around 60 sales over $1,000,000 for 2019.

The median sales price for Condos and Townhomes in the Sedona area for the last 12 months came in at $308,250, a 7% increase over $287,750 for 2018. The number of transactions for the last 12-month period came in at 139, a 25% increase over the number of sales in 2018.

Cumulative days on the market came in at 81 for the last 12-month period down from 89 days from the previous 12-month period. Even with the number of sales down 9% and inventory on the rise, time on market continues to drop. This too will be an indicator to keep our eyes on in the upcoming months.

Camp Verde: The median sales price for single family homes in the Camp Verde area continues to show strength as the median sales price for the last 12-month period rose 10% to $267,500 over the previous 12 months at $243,000. As with all areas of the Verde Valley the number of transactions is off significantly with a 19% drop in the number of sales to 98 sales over the previous 12 month’s 120 sales. The median sales price for the first 9 months of 2019 came in at $266,500 up 11% from the first 9 months of 2019. This increase in sales price came in spite of the 17 drops in sales in the first 9 months to 76 sales down from 91 sales in the first 9 months of 2018.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12-month period came in at $225,000 up 4% from a year ago. That is an all-time high for the median sales price in this area. The number of sales was down 5.5% to 69 sales compared to the previous 12-month period 73 sales. The median sales price for the first nine months of 2019 came in at $219,000 up 9.5% from the first nine months of 2018. The number of sales came in virtually the same at 59 sales for the first nine months compared to the first 9 months of 2018 at 58.

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $290,000 up 13% from a year ago. The Cottonwood and Cornville market’s steady increase in value shows a 225% increase in median sales price over the last 8 years, an average of 28% a year! Again, with the other areas of the Verde Valley the number of transactions is off 3.5% to 542 sales compared to the previous year of 562.

The Bottom Line: The number of single-family sales is down in the Verde Valley, yet prices remain flat in Sedona and strong in the rest of the Verde Valley. Interest rates are great, the overall economy is strong and buyers are still coming into our area. Keep your eyes on the amount of residential inventory and the cumulative days on market, they will be the initial indicators of a change to come.

For the complete Third Quarter 2019 Report

Recent Comments