Sedona and Verde Valley Real Estate

Second Quarter 2018

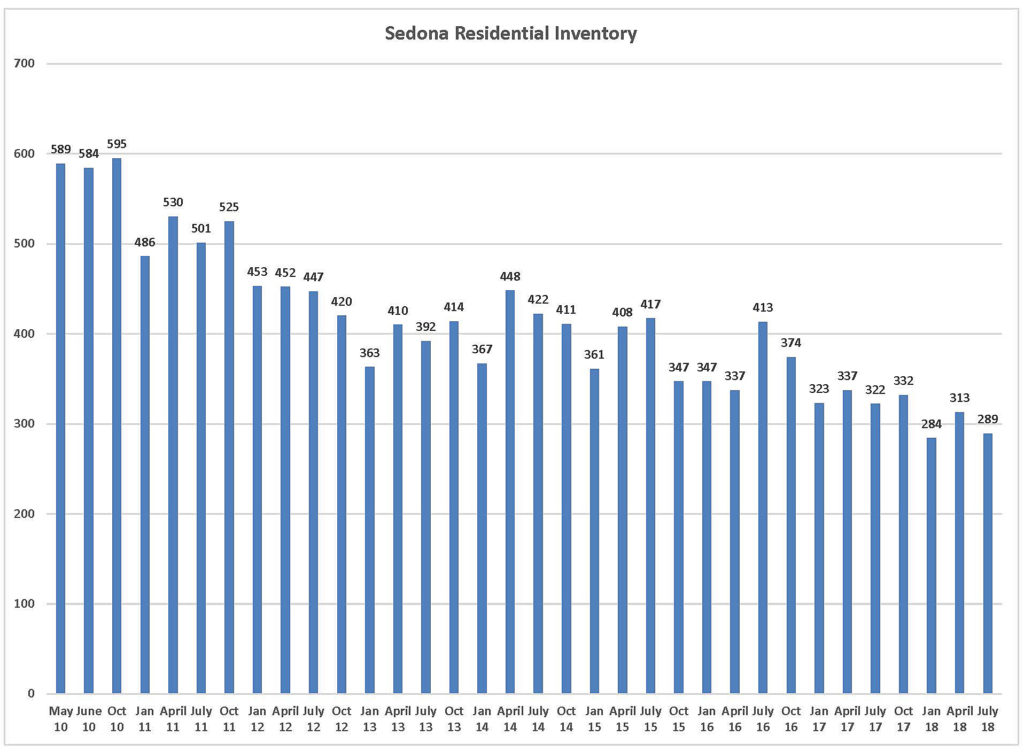

There is one word that is defining real estate all over the country, INVENTORY. From Bangor, Maine to San Francisco we are experiencing a shortage of residential property for sale, and Sedona and the Verde Valley is right there with them. In July of 2014 there were 448 residential properties for sale in the Sedona area, that includes single family homes, condos, townhomes, manufactured and mobiles homes. As of this writing there are 289 residential properties for sale. That is a 45% drop in available properties for sale. In the Sedona area for residential properties sold priced below $1,000,000 there is only a 4 month supply of residential properties for sale. A market said to be in balance would have a 6 months’ supply of properties, truly we are in a strong sellers’ market.

In the Cottonwood-Cornville area there is a 2.5-month supply of homes for sale below $400,000, in the Camp Verde area there is a 3-month supply of homes for sale below $300,000 and in Rimrock there is a 6-month supply of homes below $300,000, the only area of the Verde Valley market that is in balance.

As can be expected when inventory is in short supply prices can be anticipated to rise and in the Sedona area the rise in prices is approaching the highs of the top of the market in 2006. For the first 6 months of 2018, the median sales price of a single-family home came in at $578,250 a 14% increase over the first 6 months of 2017 and just a few percentage points below the previous high for the first 6 months of the year in 2006.

The rest of the Verde Valley is no different. The median sales price for all areas of our market are reaching their highs of the top of the market in 2006. Cottonwood came in at $255,000 for the first 6 months of 2018, Camp Verde came in at $225,000 for the first 6 months of 2018 and Rimrock-Lake Montezuma came in at $189,000.

Should we be worried that we are nearing some sort of bubble in the market? I don’t think so. You have to remember that this is just one man’s opinion and you all know about those… But here I go. At this point compared to 2006, there are a number of factors that are totally different:

• The overall economy is diversified with all segments hitting their stride, the ecomony is not riding on the back of the housing market as it was in 2004, 05 and 06.

• Home builders were averaging 1,558,000 new single-family homes per year. For the last three years they are averaging less than half of that at 750,000 single family homes per year.

• The excessive number of homes built in those years created a serious over supply in the market.

• We are in a housing shortage crisis. Homebuilders are not building enough homes to satisfy the number of households being creating, we need more homes. It appears that it will take several more years for homebuilders to begin building enough homes to satisfy the market

• Baby Boomer homeownership is at 75%, and according to one survey, 85% say they have no plans to move

• Interest rates have been at historic lows and homeowners with those low interest rates want to keep them with no desire to sell

• The “Short Term Rental” phenomenon has created a segment of the market in Arizona that did not previously exist.

• Notice of trustee’s sales, my canary in the mine shaft, are lower than any time in the last 13 years.

It took many years of overbuilding to get us into an inventory glut and it will take a number of years to get us out of this inventory shortage.

Just the Facts:

Sedona Area:

The median price of a single-family home rose 13.75% in the last 12-month period to a median sales price of $557,500, its highest point since the same time period in 2006-07. The short supply of homes for sale is driving prices up, combined with the continued increase in the number of transactions which are at 492 sales for the last 12 months, their highest number since 2004-05. The median sales price for the first 6 months of 2018, for a single-family home rose a breathtaking 14% over the first 6 months of 2017, to $578,250.

Vacant land transactions year over year showed a solid gain up to 155 sales, 7.6% over the same period a year ago, and the highest number of sales since 2005-06. The median sales price for the last 12-month period came in at $134,000 a decrease over the same time period a year ago. But keep your eyes out. Vacant land sales for the first 6 months of the year came in at 91 transactions with a median sales price at $150,000, there is movement afoot.

The Sedona area luxury market, prices over $1,000,000, came in at 45 sales in the last 12-month period, its highest number since the same period in 2006-07 and a 25% increase over a year ago. Inventory in the luxury market has remained steady with 72 listings. Year to date 2018 is showing real strength with 28 sales so far this year, which could put it up there with one of the best years ever.

The median sales price for Condos and Townhomes in the Sedona area for the last 12 months came in at $287,750 a 3% increase over 2017. The number of transactions for the last 12-month period came in at 118 remaining steady when compared to all of 2017.

Cumulative days on the market came in at 95 days down 9% from the same time period a year ago and reaching near record lows. A further indication of the overall strength of the Sedona market.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for the last 12 months continued its meteoric rise, jumping to $227,500 a 10.4% increase over the previous 12-month period. The rise in prices was fueled by the 20% increase in the number of transactions up to 119, sales the highest number since 2004-05.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12-month period came in at $199,900 up 17.5% from a year ago the highest number since 2006-07. The number of sales was up 4.3% to 72 sales for the last 12 months

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $252,000 up 7.2% from a year ago. The number transactions rose a modest 5.1% from a year ago to 571 sales.

The Bottom Line: Inventory is in tight supply, there is a nationwide housing crisis-shortage. Baby Boomers are staying put, yet family households are being creating at rate of a million or so a year. Prices are rising in the markets that feed the Verde Valley so buyers are selling at higher prices when they sell and they are willing to pay more when they get to the Verde Valley and we are seeing more of them. It will be a sellers’ market for the rest of 2018.

For the complete Sedona and Verde Valley Second Quarter Report

Recent Comments