Sedona and Verde Valley Real Estate

2nd Quarter 2017

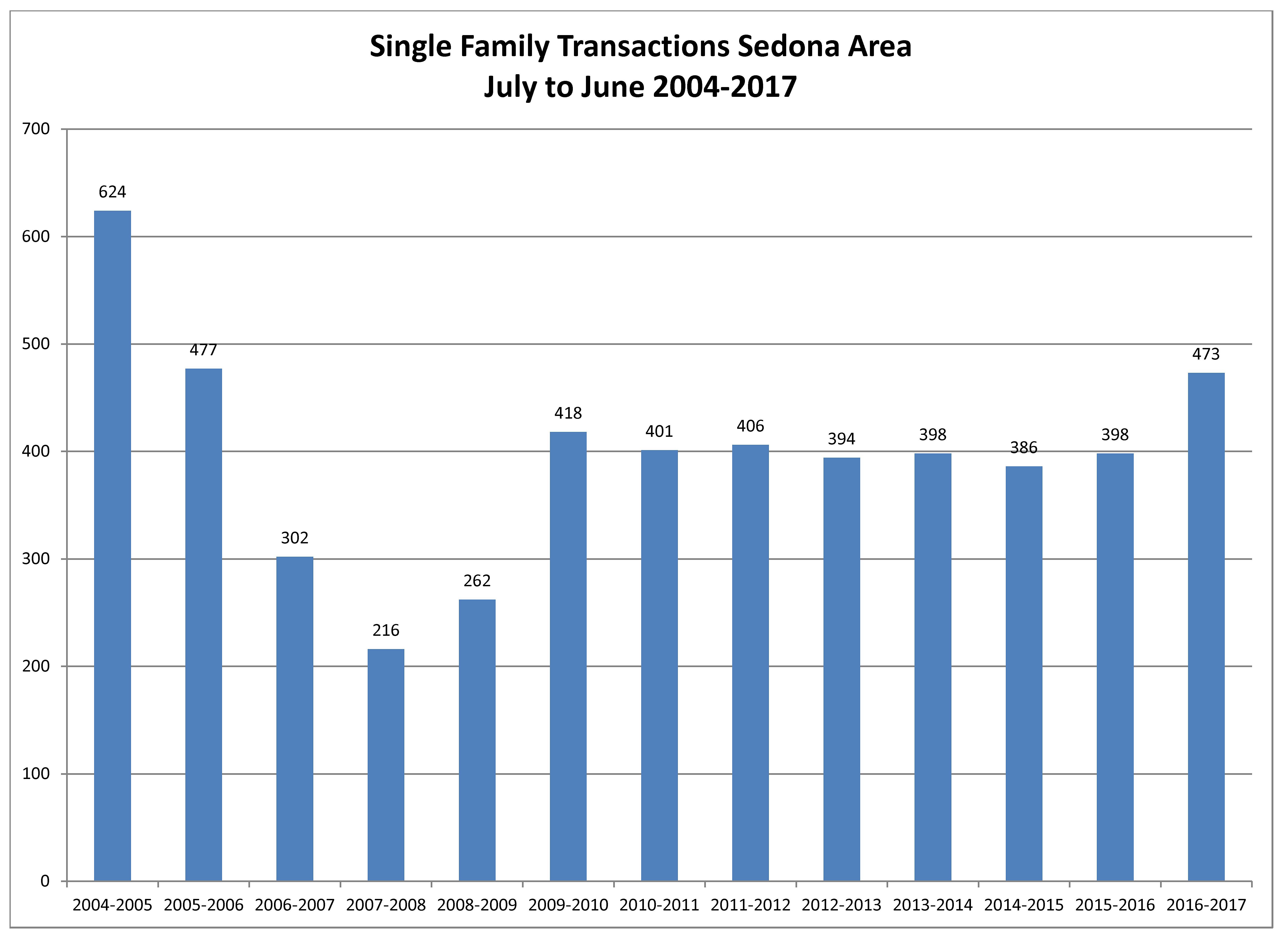

Abnormality Alert! For the first time in the last 8 years we are seeing a significant increase in the number of transactions year over year. As you can see from the graph below the number of single family transactions for the last 12 month period ending June 30 was 473 transactions. This is a 19% increase from the previous 12 month period. The additional 75 sales is not a lot of sales in the whole scheme of things but none the less it is a significant number from a percentage basis and from the perspective that last 7 years sales have been so flat in the 400 range. It is the largest number of sales since 2005-06 but still a long way off the 624 sales of the crazy days of 2004-05.

In addition to the increase in the number of single family transactions in the Sedona area, there were solid gains in the other areas of the Verde Valley, especially in the first 6 months of 2017 compared to 2016; most noteworthy was the Rimrock/Lake Montezuma area with a 43% increase in single family transactions.

Accompanying the increase in transactions all areas in the Verde Valley saw solid gains in the medium sales price of a single family home over the last 12 months period:

- Sedona – 10%

- Cottonwood -11%

- Camp Verde – 8.5%

- Rimrock/Lake Montezuma – 13%

There are several forces driving the increase in transactions and the increase in price. Lack of inventory, still great interest rates, solid economies in our feeder markets of the upper Midwest and California and a new one – the legal vacation rental. Many buyers are seeing the opportunity of the additional income generated by legal vacation rentals and the prospect of making a lot of money doing it. It remains to be seen if the extravagant income numbers being quoted actually bear fruit but for the time being it is having an influence on or market.

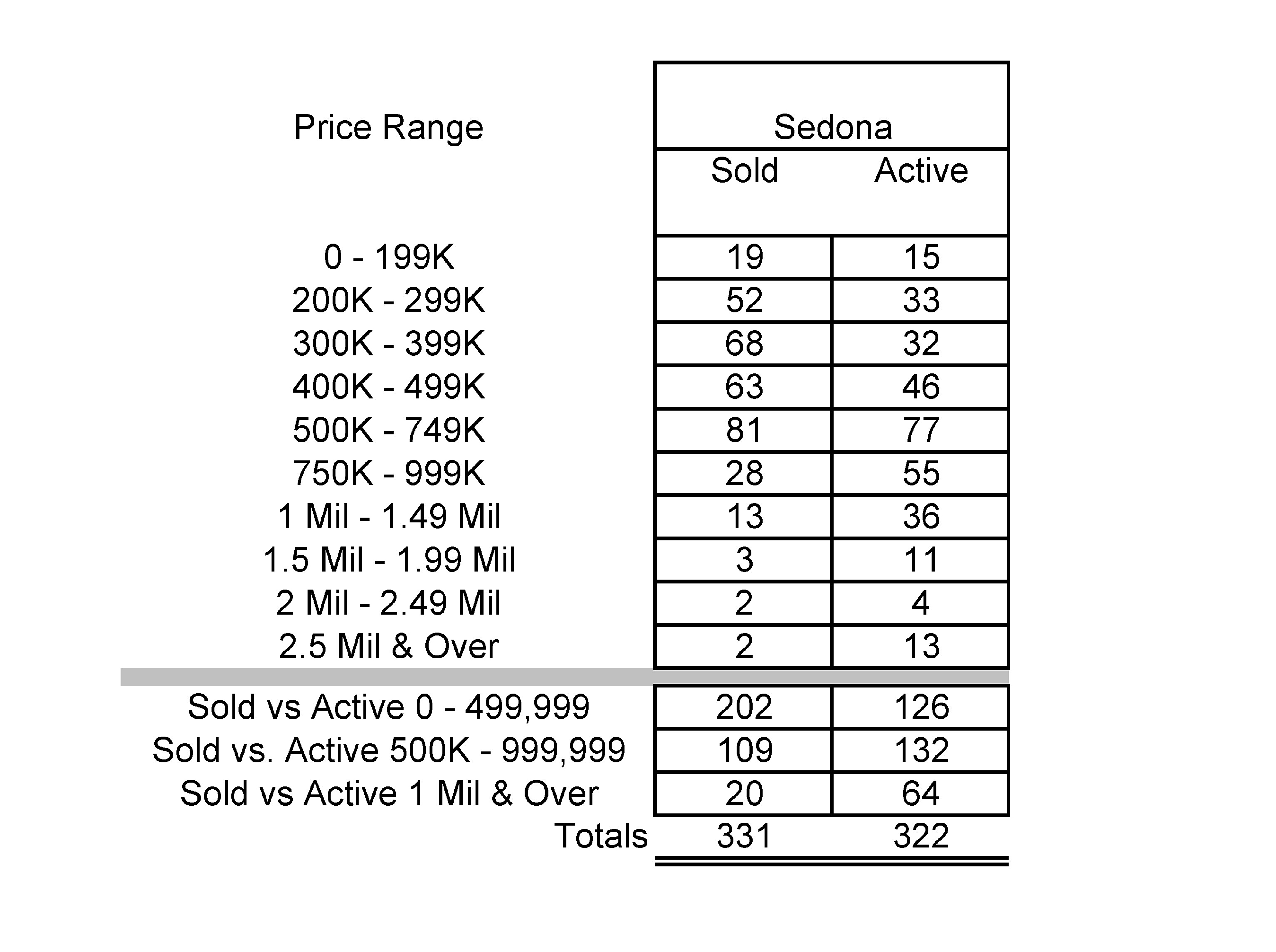

Speaking of inventory, the Sedona area has 22% less residential inventory at 322 units as of this writing, than we had a year ago. It is definitely a seller’s market below $500,000 with a 4 month supply of homes in the $200,000 to $300,000 range, a three month supply in the $300,000 to $400,000 range, and a four month supply in the $400,000 to $500,000 range. The $500,000 to $750,000 range is pretty much in balance with a six month supply of home and a strong showing with 81 sales.

Some other interesting facts of note:

- Sales over $1,000,000 in the Sedona area are up 225% in the last 12 months over the previous 12 month period with 36 sales compared to 16 in the previous 12 months. Inventory has bounced back with 64 homes on the market at this time.

- Interest rates are still hovering in the 4% range for a fixed rate 30 year conventional loan, hard to beat in any circumstances.

- Days on market for the last 12 months is 104 days the same as it was in the previous 12 months which is reflected in strong sales and increased prices.

- Notice of trustee’s sales is on track to be at their lowest point in 12 years

- The median sales price of a single family home in the Sedona area has seen a 48% increase in value since the bottom of the market six years ago!

Just the Facts:

Sedona area: The median price of a single family home rose 10% in the last 12 months over the previous 12 month period to $490,000. The number of transactions rose 19% to 473 sales in the last 12 months. The median sales price for the second quarter of 2017 is at $506,550 an 8% gain over the first quarter of 2016.

Vacant land transactions for the last 12 month took an 11% increase over the previous 12 months to 144 sales. The median sales price took a nice gain of 8% over the previous year to $140,500. Vacant land sales are still lackluster compared to the home resale market. The cost to construct a new home continues to rise making a used home still a good value.

The luxury market, over $1,000,000, catapulted to 36 sales in the last 12 months a 225% gain over the previous 12 month period. With inventory at 64 homes that equates to a two year supply home homes in this segment which has not been seen for many moons.

The median sales price for Condos and Townhomes in the Sedona area showed impressive gains with a median sales price for the last 12 months at $285,000 a 19% gain over the previous 12 months. The number of transaction in this segment jumped up 26% to 116 sales following in the footsteps of the single family market

The median price for mobile homes continues to climb to $232,500 for the last 12 months up 39% over the prices for mobile homes in the previous 12 months

Camp Verde:

The median sales price for single family homes in the Camp Verde area for the last 12 months rose 8.5% over the previous 12 month period to $206,000. The number of transactions slowed to 99 sales in the last 12 months, down 4% from the previous 12 month period.

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12 months rose 13% over the previous 12 month period to $170,000. The numbers of transactions stayed steady at 69 transactions the same as the previous 12 months.

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville areas for the last 12 months rose 11% over the previous 12 month period to $235,000. Expect year over year prices to continue to rise in the area as the median sales price for the first six months of 2017 vaulted to $250,000.The number of transactions for the last 12 months is up 10% to 543 sales.

The Bottom Line: Strong gains will continue to be seen as inventory and interest rates remain low and the economy is on solid footing. I believe that we are on the front end of a housing shortage in the United States. Household creation remains strong at about 1,000,000 households being formed each year, millennials are starting to move out on their own after many years of living with their parents and housing starts remain lackluster, creating more buyers than there are homes to buy resulting in increasing upward pressure on pricing. If there are not serious external forces impacting our market, demand will continue to remain strong and prices will stay on their upward trajectory for the rest of 2017

For the comlpete Sedona and Verde Valley Second Quarter 2017 report:https://www.randycrewse.com/wp-content/uploads/2017/07/Market-Statistics-July-to-June-2004-to-2017-with-Observations.pdf

Recent Comments