Sedona and Verde Valley Real Estate First Quarter 2020

I am going to start out this report with what I know, the sales history that we have had over the last 12 months in Sedona and the Verde Valley, and end with what I don’t know, in light of the Covid 19 pandemic, WHICH IS MASSIVE!

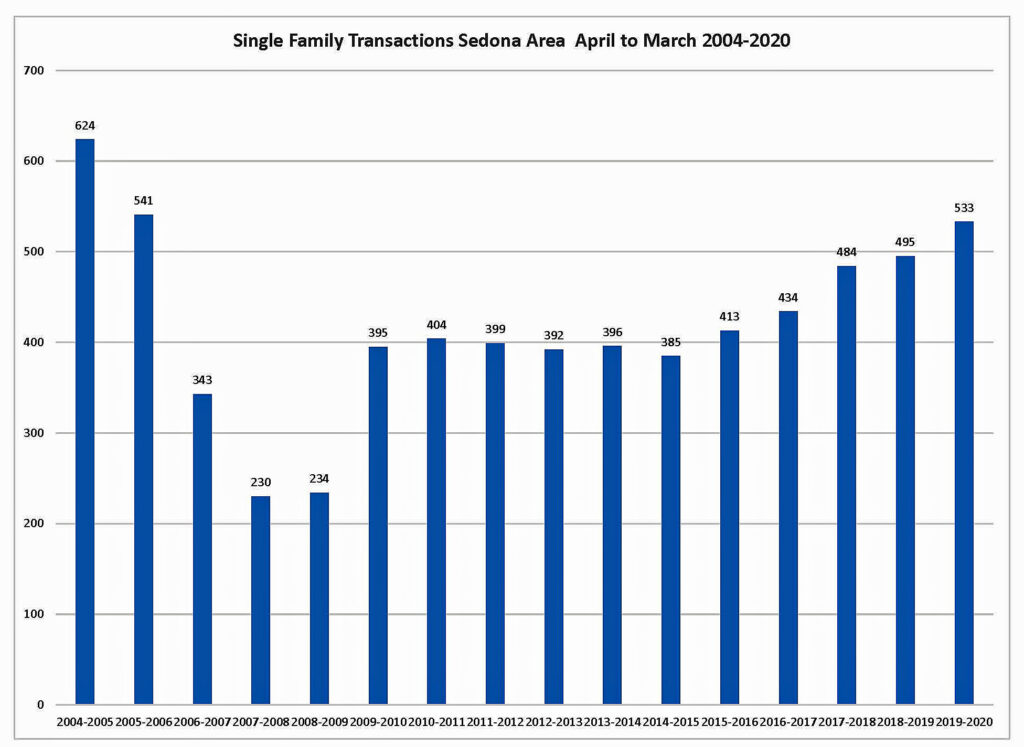

Ok, what I do know. Overall, the market in Sedona and the Verde Valley has been very strong over the last 12 months and especially in the first quarter of 2020. Sales of single-family homes in the Sedona area were up 7.6% in the last 12-month period to 533 sales. In addition to the strong sales of single-family homes over the last 12 months in the Sedona area, first quarter sales came in at 128 sales a 39% increase over 2019 first quarter sales.

In addition to the strength of the Sedona market other areas of the Verde Valley were at all-time highs for their median sales price. The Cottonwood/Cornville area came in at $290,500, Camp Verde came in at $278,000 and the Rimrock/Lake Montezuma areas came in at $232,500. Low inventory is a major contributing factor to the strength of these markets.

So, we know where we have been, now to where we are going. Over the next few paragraphs I am going to employ all of the tools of the trade; dart board, crystal ball, gut ( I wish it was smaller), intuition, ouigi board, brain, and of course the Airport Vortex, to come up with my real estate forecast for the rest of the year. I am normally pretty confident of my predictions, for this one I am not. Why, as I said in the first paragraph, what I don’t know is MASSIVE.

The economy of Sedona and the Verde Valley is an economy whose driving force is tourism and hospitality. These two areas are probably the hardest hit areas of the economy, and will have an extra impact on our local one. They encompass all of the tourism based small businesses, hotels and restaurants in the Verde Valley, all of which have been significantly impacted since the stay in place orders have been in effect. You just have to drive down the street to see all of the empty parking lots in front of businesses to know that there will be a substantial impact.

Which brings me back to the unknown. The Feds have put in place two trillion dollars in aid for individuals and businesses and plan for more. But will it be enough. For businesses that were already under financial stain will they survive, even with the Feds cash infusion, and what will be the total job losses.

We all know that there are at least 1,000 short term rentals in the Sedona area alone. All of these folks whether they realized it or not, are in the hospitality business. Most folks that pay attention to the economy know that the hospitality industry, when markets turn down, is one of the first segments impacted. These short-term rental owners, now are all acutely aware of this fact. The longer that the recovery takes some of these folks may decide that they need to transition to the long-term rental market or just sell.

Back to the unknown. At this point we do not know how long it is going to take to flatten the curve and get new cases of the virus under control. Without a nationwide plan in place it looks to me like there be continual outbreaks in different areas of the country. So how can we feel comfortable about going anywhere with the insidious nature of this virus, when community transmission will be a real threat at any time. Will there be drug therapies that will knock this stuff down and lessen the severity and death rate? If they get the virus under control in the next month or two will it come back next fall and winter like most seasonal colds and flu do? And the big question, when will we get an effective vaccine and when will they get 330 million doses to Americans and 6 or 7 billion doses for the rest of the world?

More unknown. When are folks going to feel safe about going out in public, to a restaurant, to a movie, to a concert or ball game? When are we going to feel safe about getting on a plane? When are we going to feel safe about staying in a hotel room that we don’t know anything about the last folks that stayed there? I think I can say safely that in spite of the amount of cabin fever that is building up that we will not all rush out at once and move about the country, and when we do it may not be far from home and that for some of us we will not feel safe for quite some time.

All of these unknowns are going to play a part in how our economy fares over the rest of 2020 and most likely 2021 until we get a vaccine in place and lesson the fear of the unknown.

Back to what I think I know. Up until the virus hit in full force our local economy was strong and the real estate market was hitting on all cylinders. Inventory was tight and still is. We live in an area of low density, the hardest hit areas are all in areas of high density, and people will want to be in more rural areas. Interest rates are low and look like they will remain so in order to stimulate the economy’s recovery. Baby Boomers are still retiring at the rate of 10,000 per week and many want to warm up and dry out in Arizona. The long term looks solid but the short term is very fuzzy.

Just the Facts:

Sedona area: The median price of a single-family home rose 1% in the last 12-month period to a median sales price of $569,000, its highest point since the same time period in 2007. The number of transactions came in at 533 sales for the last 12 months a 7.6% increase over the last 12-month period. It is interesting to note with the strong gain in the number of sales, and tight inventory during the last 12 months, the increase in the median sales price was a stingy 1%. With this in mind the first quarter sales were strong with a 39% increase in first quarter sales compared to 2019 and a 2% increase in median sales price to $571,100. Without the backdrop of the Covid 19 virus, from all outward appearances the market was off to a strong start in 2020.Vacant land transactions year over year remained relatively steady coming in at 150 sales for the last 12 months compared to 160 sales in the previous 12-month period. The median price took a robust jump of 11.6%% to $170,000 for the last 12-month period. Vacant land inventory is up slightly over the first quarter but the trend line over the last several years is showing a tightening of the supply of vacant land inventory which may be setting us up for upward pressure in pricing.

The Sedona area luxury market, prices over $1,000,000, came in at a robust 54 sales in the last 12 months tying the previous high of 54 in 2006. First quarter sales of homes over $1,000,000 came in at 10 sales compared to 12 sales in the first quarter of 2019. Inventory of homes over $1,000,000 is at 77 homes making up 28% of the market of available homes but only 8% of the number of sales.

The median sales price for Condos and Townhomes in the Sedona area for the last 12 months came in at $327,500 a 5.6% increase over $310,000 for 2019. The number of transactions for the last 12-month period came in at 116 down 14 % from the total sales in 2019.

Cumulative days on the market came in at 89 days for the last 12-month period virtually unchanged from the previous 12-month period. Cumulative time on market over the rest of the year will be one of the true indicators of the strength of the market, keep your eyes on this gauge.

Camp Verde: The median sales price for single family homes in the Camp Verde area for the last 12 months again proved to be very strong rising sharply to $278,000 up 11% over the previous 12-month period. Camp Verde prices continue to remain strong. The number of sales was down to 99 sales in the last 12-month period. Inventory in the Camp Verde area remains very low with only 56 residential properties for sale in all categories.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12-month period came in at $232,500 up 8% from a year ago. The number of sales was up 3% to 75 sales for the last 12 months. This median sales price sets the all-time record for this area. Just to further indicate the strength of the market in this area the median sales price for the first 3 months of 2020 came in at $251,825 a 20% increase over the first quarter of 2019.

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $290,500 up 6.4% from a year ago, the highest median sales price ever recorded. The number of sales for the last 12 months came in at 566, a 7% increase over the previous 12-month period a further indication of the power of the market in this area.

The Bottom Line: The last 12 months and the first quarter of 2020 were very strong. Inventory is low and interest rates are great. The market will be paused for the next month or two at best. We are in a place that is foreign to all of us and there are too many unknowns that need to come more into focus over the next several months andthe rest of the year before we will know where we are going. We have to come together, support one another and hang in there with the goal of coming out on the other side.

For the complete Sedona and Verde Valley First Quarter 2020 Review

Recent Comments