Sedona and Verde Valley Real Estate First Quarter 2019

The First quarter of 2019 is in the books. For the last several years the real estate market in the Verde Valley has been experiencing nothing but upward pressure as has most markets in in the United States and especially the West. Upward pressure resulting from increased sales and low inventory, just exactly as you would expect.

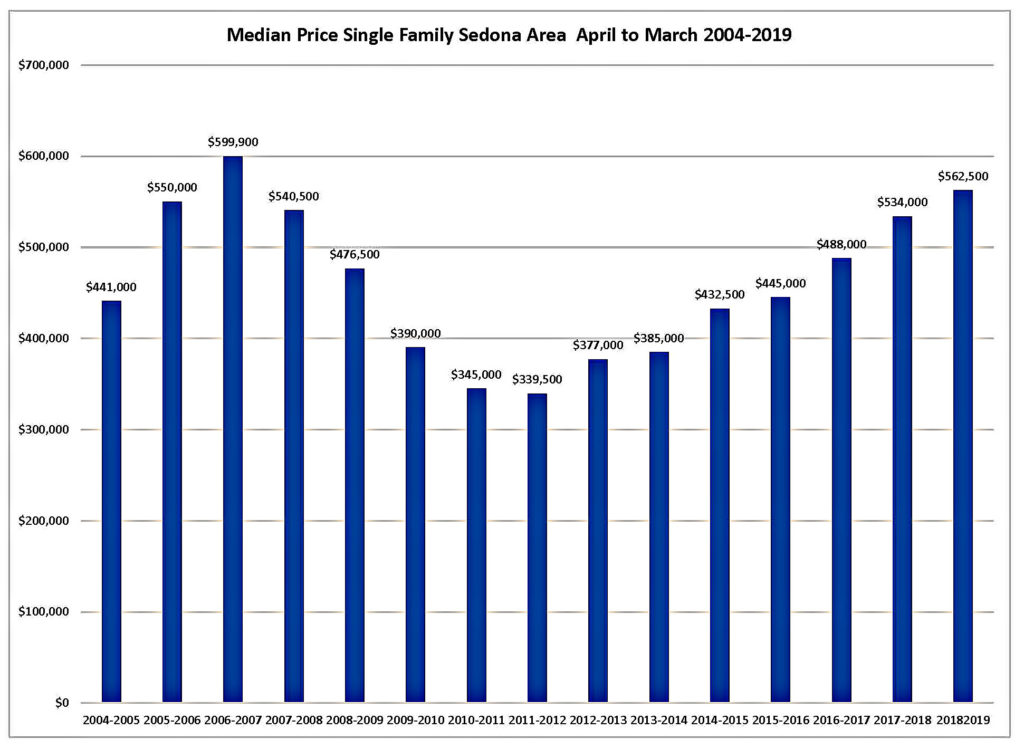

In the Sedona area year over year price gains since 2011-12 have resulted in a 65% increase in the median sales price of a single-family home, an average of 9.2% per year bringing us to a median price of $562,500, exceeded only by the 2006-07 year. This is terrific by any measurement.

This increase in median sales price is mirrored and exceeded in other areas of the Verde Valley:

Cottonwood: $273,000, a 215% increase, now at its all-time high

Camp Verde: $250,000, a 217% increase

Rimrock: $215,000, a 262% increase

So, we know where we are and where have been, but where are we going? I am going to go out on a limb and say we are at or nearing a possible turning point. So, I am sure you are asking, WHAT!

Again, I am saying possible. I am saying this for a couple of reasons. The first is that residential inventory in the last 90 days his jumped up 24% in the Sedona area and up 13% Verde Valley wide. While this may be a seasonal adjustment, our annual Spring increase, it also comes at the same time that we are seeing a 9% drop in the number of single-family homes sold in the Verde Valley in the first quarter of 2019 compared to 2018. In the whole scheme of things, the Verde Valley is a small market and one quarter of sales is does not a trend make, but it is worth noting. So, stay tuned!

With median sales prices at or reaching all-time highs in the Verde Valley I want to address affordability of the median priced single-family home for families living and working in the Valley. This is another factor that will have an impact on the price of homes in the Verde Valley as prices rise.

For families working in the Verde Valley their ability to buy a home is based on how much of a loan that they can qualify for. This is based on their gross monthly income and the total monthly amount of their installment debt. Their installment debt is the principal and interest on their loan, monthly homeowners’ insurance, monthly taxes on the home and any other installment debt, for instance car loans and credit card debt.

For the purpose in looking at the affordability of the median priced single family home in our market, I am going to assume a 97% FHA loan, use a current interest rate 4.5%, that the average family has a car loan or loans of $400 per month and $100 of other installment debt. For taxes and insurance, I am basing the taxes looking at the taxes for the median home in each of the markets and an educated guess for the homeowner’s insurance based on the price of the home. Lenders allow a range of debt to income ratio in the 43% to 49% range. I am going to use 45%. The 3% downpayment and 3% for closing costs for the median priced home will run $12,900 to $16,500, no small feat for these working families.

Cottonwood: $273,000 price, $264,800 loan, PITI loan payment $1,600, total debt $2,100. Requires a monthly income of $4,884, or $58,600 per year. Based on the 2017 US Census Bureau 5-year average for Cottonwood the median household income was $40,571.

Camp Verde: $250,000 price, $242,500 loan, PITI loan payment $1,445, total debt $1,945. Requires a monthly income of $4,523 or $54,300 per year. Based on the 2017 US Census Bureau 5-year average for Camp Verde the median household income was $40,464.

Rimrock: $215,000 price, $208,550 loan, PITI loan payment $1,231, total debt $1,731. Requires a monthly income of $4,025, or $48,300 per year. Based on the 2017 US Census Bureau 5-year average for Rimrock the median household income was $38,900.

So, you can see from the above examples how the median working family in all areas of the Verde Valley is essentially being priced out of a real estate market that is being dominated by baby boomer retirees and investors buying homes to use as short term rentals. A continued rise in the median sales prices of homes in the Verde Valley will have long term impacts on the viability of our communities.

Just the Facts:

Sedona:

The median price of a single-family home rose 5% in the last 12-month period to a median sales price of $562,500, its highest point since the same time period in 2007. This results in a 65% increase over the last 7 years, just over 9% per year. The number of transactions came in at 495 sales for the last 12 months. With this modest 2% gain, we might be seeing the first indications of our market cooling off a bit. This seems to be backed up by the 12% slowdown of sales in the first quarter of 2019 compared to 2018 with 92 sales in 2019 and 107 sales in 2018. The median sales price for the first three months of 2019 came in at $559,500 this is just a 2% increase over the first quarter of 2018.

Vacant land transactions year over year remained steady coming in at 160 sales for the last 12 months compared to 164 sales in the previous 12-month period. The median price rose a modest 2.6% to $152,250 for the last 12-month period.

The Sedona area luxury market, prices over $1,000,000, came in at a robust 53 sales in the last 12-month period only topped by 54 sales in 2005-2006. This was a 32.5% increase over the previous 12-month period. In spite of this increase in sales the number of luxury homes for sale is currently at 83 homes compared to 64 homes just 90 days ago. The luxury market makes up 28% of the residential inventory currently for sale in the Sedona area.

The median sales price for Condos and Townhomes in the Sedona area for the last 12 months came in at $308,500 a 5% increase over $294,000 for 2018. The number of transactions for the last 12-month period came in at 144 an 8% increase over the number of sales in 2018.

Cumulative days on the market came in at 87 days for the last 12-month period down from 102 days from the previous 12-month period. Based on time on market, well priced homes are moving quickly.

Camp Verde:

The median sales price for single family homes in the Camp Verde area for the last 12 months rose sharply to $250,000 up 14% over the previous 12-month period. This sharp increase in price came in despite the 12% drop in the number of transactions in the last 12 month to 104 sales. There are 69 residential homes for sale in the Camp Verde area which is about an 8-month supply

Lake Montezuma and Rimrock:

The median sales price for single family homes in the Rimrock and Lake Montezuma area for the last 12-month period came in at $215,000 up 12% from a year ago. The number of sales was up 5% to 73 sales for the last 12 months. This is the highest median sales price in this area other than the all-time high in 2006-07

Cottonwood and Cornville:

The median sales price for single family homes in the Cottonwood and Cornville area for the last 12 months came in at $273,000 up 9.2% from a year ago, the highest median sales price ever recorded. This record median sales price again is despite a 7% drop in the number of sales in the last 12 months compared to the previous 12 months.

The Bottom Line:

Prices are at all time highs. There has been an uptick in inventory in the first quarter and a slowing of the number of transactions. If this trend continues into the Fall we will see prices soften later this year. Interest rates are in the 4.25% to 4.5% range for now but will also have an impact if they rise later this Summer and Fall.

For the complete Sedona and Verde Valley First Quarter Report

Recent Comments