Sedona and Verde Valley Real Estate 2019 in Review

Looking back at 2019 is easy, we just have to look at the facts: Inventory, number of sales and price. The number of residential properties for sale in the Verde Valley was tight for the entire year with the low in January, bumping up in the spring and tightening up throughout the year. The number of single-family home sales was virtually unchanged in 2019 from 2018 at 1232 for 2018 and 1233 for 2019. The median sales price for a single-family home in all markets in the Verde Valley are at or near all-time highs. Sedona came in at $565,000 up just 1% from 2018, Cottonwood/Cornville came in at $290,000 up 9.4% from 2018 its all time high, Camp Verde came in at $270,000 up 9.3% from 2018, and Rimrock/Lake Montezuma came in at $230,000 up 7% from 2018 its all-time high. Overall you have to agree that the real estate market in the Verde Valley is doing well.

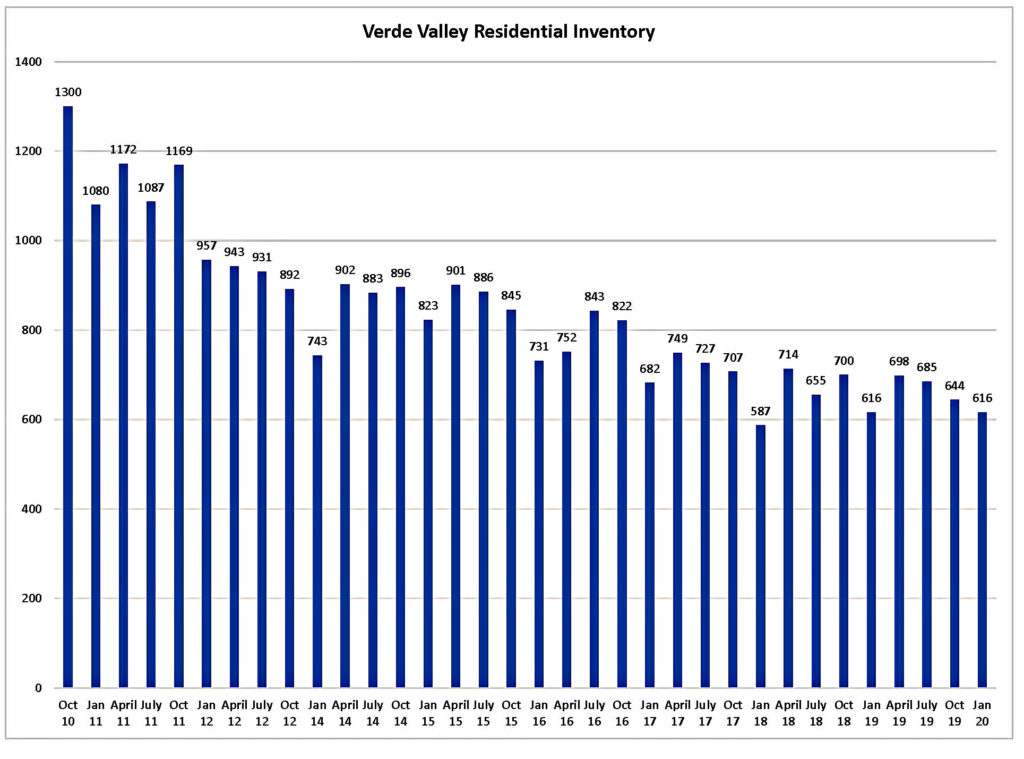

In today’s Verde Valley real estate market residential inventory is playing a disproportionate part of the market. Supply and demand, so what else is new. When you look at the graph below you can see that we are going into our third year of low inventory.

When you look at this inventory closer you see that the inventory of lower price point homes in all areas of our market continues to disappear. In Sedona in January of 2018 there were 39 properties in the $300K to $400K in January of 2020 there are 23. In Cottonwood/Cornville in January of 2018 there were 51 properties in the $0K to $200K in January of 2020 there are 34. In Camp Verde in January of 2018 there were 23 properties in the $0K to $200K in January of 2020 there are 13. In Rimrock/Lake Montezuma in January of 2018 there were 26 properties in the $0K to $200K in January of 2020 there are 10. Overall the shortage of homes for sale in the lower price points in the Verde Valley is having an impact on affordability for folks wanting to work and raise families in our communities.

That is enough about 2019 what about 2020.

Mortgage rates will stay low—or maybe go lower. Mortgage rates currently sit at 3.75%, according to Freddie Mac’s most recent numbers—nearly a 1% difference from the monthly average a year ago. In January of 2000 they were 8.5%. According to Lawrence Yun, the Chief economist for the National Association of Realtors “the 30-year fixed-mortgage rate will remain below 4 percent in the coming year, moving to 3.8 percent by the end of 2020. Interest rates will remain low, as long as we have government backing of mortgage-backed securities, but mortgage rates may increase as inflation kicks in and economic activity markedly picks up.”

Prices will keep on rising. Home prices will continue their climb upward, according to experts, largely thanks to tight inventory and high demand.

As Daryl Fairweather, chief economist for real estate brokerage Redfin, explains, “Right now we aren’t seeing a ton of new listings. Without more listings coming on the market, there will be more competition starting off in early 2020 and that will lead to more price pressure.”

Inventory will be tight. Housing inventory is going to remain limited for much of 2020, experts say. And interest rates and record-high homeownership tenures are a big part of the problem.

According to recent data from Redfin, the average homeowner is staying in their home 13 years—up from just eight years in 2010. In some cities, homeownership tenures are as high as 23 years.

As I have stated before, many homeowners have locked in low interest rates, baby boomers are staying healthy longer and staying put in their existing homes. You cannot buy what is not for sale. The Baby Boomer generation is part of the challenge for Millennials, as many are choosing to age in place keeping more homes off the market than ever before. A recent study from Freddie Mac shows that if today’s older adults those born between 1931 and 1959—behaved like earlier generations, then an additional 1.6 million homes would have hit the market by the end of the last year. That would have a significant impact on markets throughout the country including the Verde Valley.

Just the Facts:

Sedona area: The median price of a single-family home rose to $565,000 the highest amount since 2006, topped by only the $590,000 in 2006. This was just a 1% increase over 2018, the slowest increase in 6 years. This slowdown in the increase in median sales price was joined by a 3% decrease in the number of sales in 2019 to 496, down from 511 sales in 2018. This was the first decline in the number of sales since 2014.

Vacant land transactions for 2019 came in at 152, a 14% decrease over 2018. With the dramatic decrease in the number of sales you would expect a weakening in sales price but instead we saw a 7% increase in the median sales price to $160,000. Although the median sales price for vacant land has hovered in the $140,000 to $150,000 range for many years, this is the highest median sales price for vacant land since 2008. This comes on the heels of a decline in vacant land inventory to the lowest inventory in over 10 years. 2020 could be the break out year for vacant land

The luxury market for 2019 represents 11% of the total number of single-family sales in the Sedona area with a record number 56 sales over $1,000,000. Currently there are 87 homes listed in the Sedona area over $1,000,000 which is 31% of the residential properties for sale.

Cumulative days on the market came in at 82 days, a 4% drop from the 85 days in 2018. The low cumulative days on market reflects the overall shortage of inventory and will remain low until we see inventory increase.

The median sales price for Condos and Townhomes in the Sedona area was up 5% over 2018 to $310,000. The number of transactions for the last 12-month period is 134, virtually unchanged from 2018 but at one of the highest levels since 2003.

The median price for mobile homes came in at $279,750 up a dramatic 26% over 2018. Sales remained flat at 36 sales. Inventory of mobile homes is at its lowest levels in many years.

Camp Verde: The median sales price for single family homes in the Camp Verde area for 2018 was $270,000 up 9.3% from 2018. The number of sales was down 15% to 97 sales, a direct reflection of the homes for sale in the Camp Verde area.

Lake Montezuma and Rimrock: The median sales price for single family homes in the Rimrock and Lake Montezuma area for 2019 was $230,000 up 7% from 2018. This is an all-time high for this area. The number of sales came in at 80 sales up 14% from 70 sales in 2018. Inventory of homes in this area is very tight.

Cottonwood and Cornville: The median sales price for single family homes in the Cottonwood and Cornville area for 2019 was $290,000 up 9.4% over 2018. This is the highest median sales price in this area ever. The number of sales in 2019 was up 4% over 2018 to 560 sales contributing to the all-time high price.

The Bottom Line: Inventory looks to remain tight for 2020, and mortgage rates are projected to remain under 4%, both factors allowing for a continued upward pressure on prices, although project to be slower than in the last few years. The economy remains solid with low unemployment allowing for our feeder markets to remain strong. So overall the market should remain solid and it should be a good year for Sellers and a challenging year for buyers.

Recent Comments