Real Estate for Sedona and the

Verde Valley Third Quarter 2013

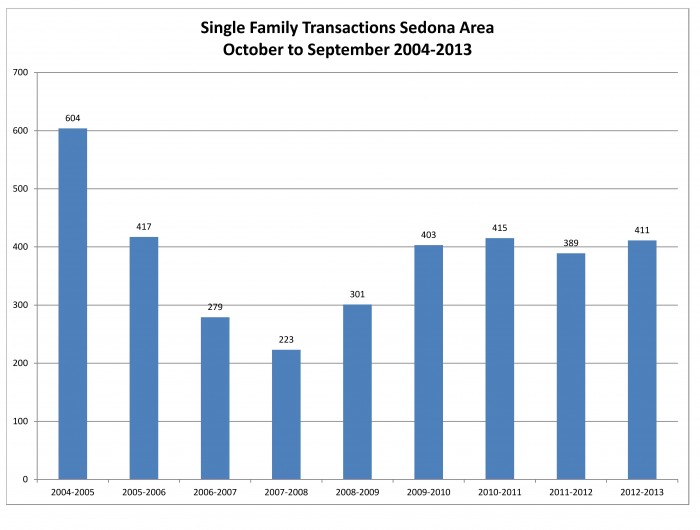

Steady with upward pressure is my standard answer to “what is going on with the real estate market”. Since 2009 the Sedona market has settled into about 400 single family homes sold per year. During that time we have seen the number of residential properties on the market decrease from around 700 properties in May of 2009 to the 400 or so properties we have on the market today, thus providing the main reason for the upward pressure that we have seen in the last 12 months and year to date 2013 over year to date 2012.

Current forces in the Sedona and Verde Valley real estate market are the same forces that are being seen over most parts of the country:

- Interest rates remain low, as of this writing 30 year fixed rate loans are in the 4.25% range, up from earlier in the year but still at historical lows. Many experts are forecasting an increase in rates during 2014.

- Inventory of homes for sale is still very tight but with the increase in prices we are seeing investors that have been waiting for prices to increase finally seeing their properties come up from being under water and putting them on the market

- Buyers are coming in from the upper Midwest and California after having been able to finally sell their homes at an increased price.

As I stated above steady as she goes has been the watch word for the number of single family homes sold over the last four years as illustrated by the graph above. You cannot deny the fact with the last four years of single family homes sales ranging around 400 sales, that this is our market and should be a pretty good bell weather to predict change along with the amount of inventory for sale at any given time.

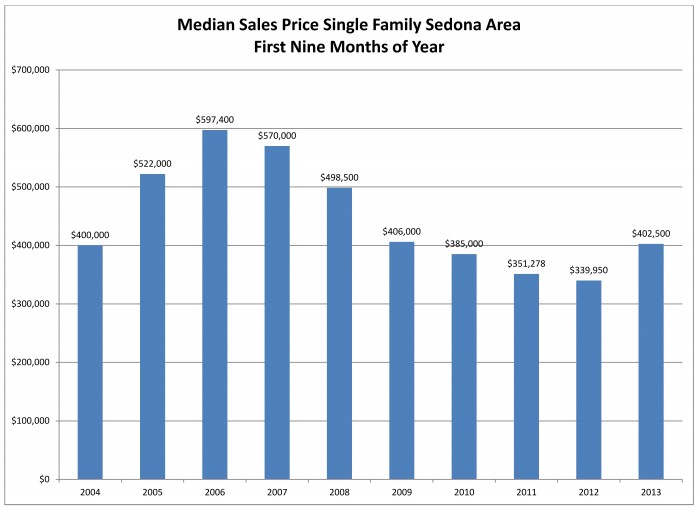

The last 12 months and year to date 2013 have given the Sedona area its first real taste of price increases. We saw a small increase in 2012 over 2011, signaling the bottom of the market but what we are seeing in the last 12 months is significant. Single family home prices year to date 2013 over the same time period in 2012 have risen a whopping 18.3%.

With the median sales price of a single family home moving into the $400,000 range this puts us right in line with prices from 2004, nine years ago before the big run up in 2005 and 2006. I have to ask is this type of price increase, 20% per year, sustainable and how much higher can it go. I believe the entire real estate market nationwide is fragile and can be impacted by an increase in interest rates and job creation. We will just have to hold on and see.

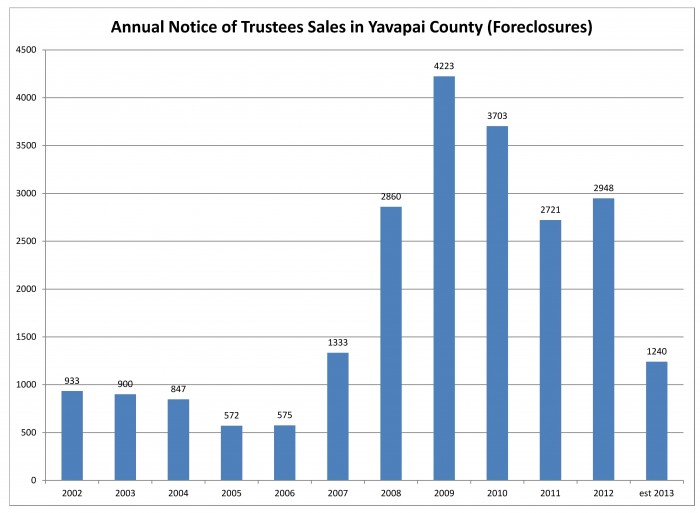

One of the real bright spots in the market and and probably the main reason for the stability and increase in pricing is the continued drop in the number of Notice of Trustees Sales. For Yavapai County we are heading to a 60% decrease in the number of Notice of Trustees filings for 2013 compared to 2012. This is the same trend that is being seen all over the country.

Since the big increases of Notice of Trustees Sales in 2007 and forward we have seen a significant number of homeowners lose their homes to foreclosure. With the shake out of these homeowners and price increases that are occurring, fewer and fewer homeowners are underwater and are able to sell when they are faced with the need. Foreclosures and short sales and still a part of the market but their influence is being diminshed.

Just the Facts:

Vacant land transactions for the last twelve months were 135 transactions, a 20% increase over the previous 12 month period. Median sales price for land sale was up 26%. With transactions up and prices up, I am saying that we are beyond the bottom of the market for vacant land. If you are wanting to purchase vacant land in the Sedona area, prices will be going up as you delay.

The luxury market, over $1,000,000, for the last 12 months continues to find is footing with 33 sales in the last 12 months. This is almost twice the pace of sales seen on 2009-10 but still significantly off the pace seen in 2006.

Cumulative days on the market has seen a significant drop to 122 days, a 20% decrease over the previous 12 month period. Well priced homes coming on the market are selling and closing quickly.

The median sales price for Condos and Townhomes in the Sedona area has settled into the $215,000 range for the last 12 month period which is slightly below the $221,000 range for 2012. The number of transactions for the last 12 month period is 111, right in the range seen in 2012.

Camp Verde:

The median sales price for single family homes in the last 12 months in the Camp Verde area was $146,750 up 13.8%% from the previous 12 month period. The number of transactions is up slightly to 116 sales from the previous 12 month’s 112.

Lake Montezuma and Rimrock:

The median sales price for single family homes the last 12 months was $111,500 up 27% over the previous 12 month period. The number of transactions was steady at 83 sales.

Cottonwood and Cornville:

The median sales price for single family homes in the last 12 months was $157,200 up 13.5% over the previous 12 month period. The number of transactions was down about 6% to 493 sales.

Bottom Line: Prices are going up for all segments of the market, in all areas of the market. Rimrock was one of the hardest hit area and has seen the biggest jump in prices. Real estate is still a real bargain in the Rimrock and Lake Montezuma area. Sedona prices have seen an almost 20% run up in the last 12 months and you just have to wonder how long that pace can keep up. The real estate market is fragile with outside forces playing a big part in it’s sustainability. The Feds have to keep interest rates down and jobs need to be created to keep real estate markets headed in a positive direction. Hopefully it will continue to be steady as she goes.

Click here for the complete 47 page Sedona Real Estate Statistics for 3rd Quarter 2013, with easy to read graphs.

Recent Comments